Summary:

- BlackRock will provide institutional investors with exposure to crypto investments.

- The heavyweight asset manager has partnered with crypto exchange Coinbase to make this possible.

- BlackRock’s Aladdin clients will access such facilities through Coinbase prime as announced.

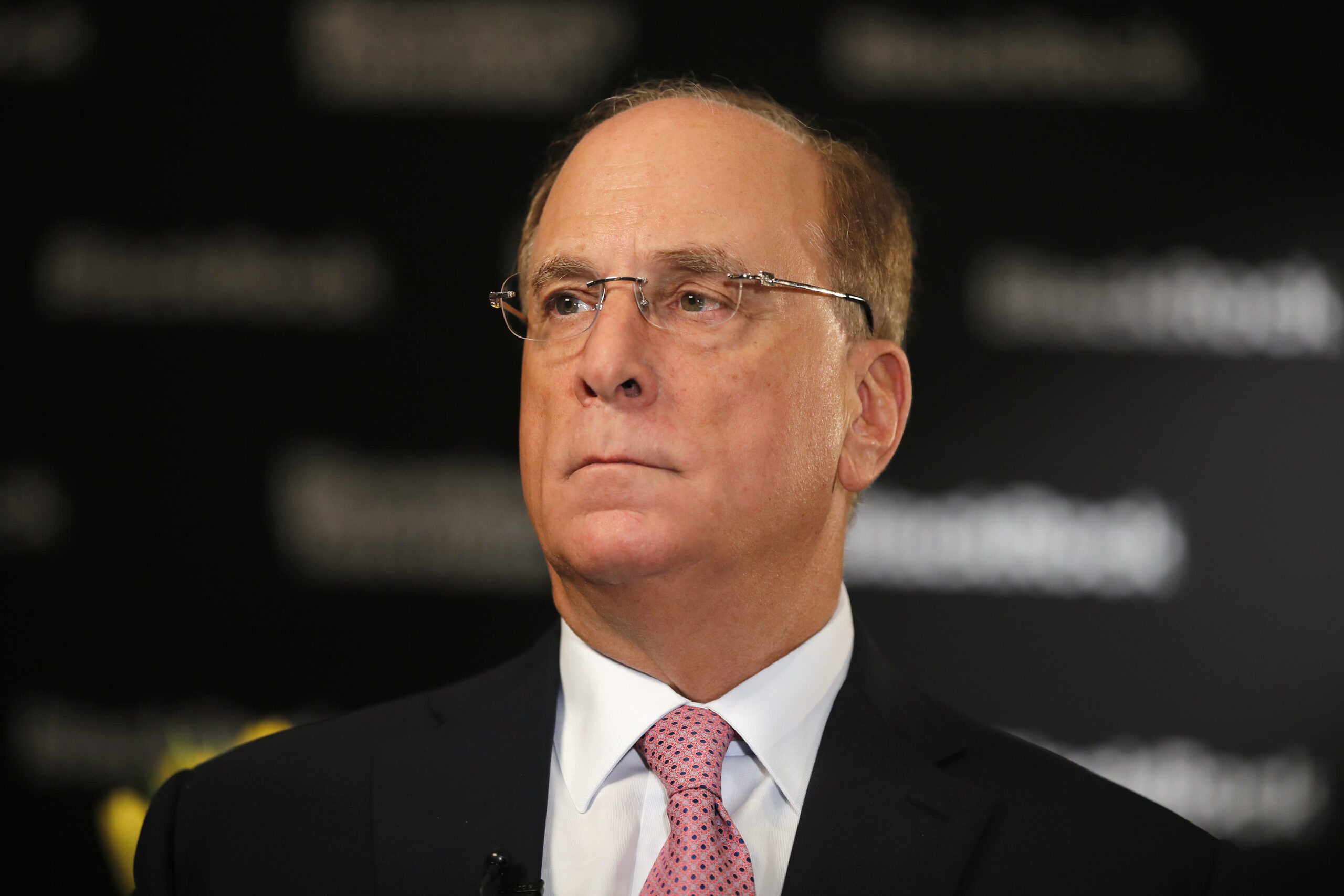

- CEO of the asset manager, Larry Fink, hinted at the development back in March.

- The news reaffirms that institutional players maintain an appetite for digital assets despite the ongoing bear market.

BlackRock, one of the world’s largest asset managers, has signed a deal to offer crypto investment exposure to institutional investors amid an ongoing bear market where tokens like Bitcoin and Ethereum remain more than 50% from their all-time highs.

The asset management behemoth with over $10 trillion in assets under management (AUM) now has a partnership with Coinbase, a leading cryptocurrency exchange company based in San Francisco.

BlackRock’s agreement with Coinbase will power cryptocurrency investment facilities for institutional investors through Coinbase prime. The service provides a secure custodial platform and advanced trading tools to over 13,0000 institutional customers.

.@BlackRock’s Aladdin clients now have direct access to crypto markets through Coinbase Prime. Read more about our partnership and mission to support growing institutional interest in digital assets. https://t.co/sxAJiXjkOm

The deal between both entities is set to kit BlackRock’s Aladin clients with direct access to cryptocurrencies. Thursday’s announcement mentioned Bitcoin as the asset customers would be exposed to.

This connectivity with Aladdin will allow clients to manage their bitcoin exposures directly in their existing portfolio management and trading workflows for a whole portfolio view of risk across asset classes.

BlackRock’s Coinbase Partnership Signals Institutional Demand For Crypto

BlackRock CEO Larry Fink previously hinted in March 2022 that the asset management powerhouse could explore crypto trading. Fink noted at the time that demand for crypto exposure was growing rapidly.

Global Head of Strategic Ecosystem Partnerships, Joseph Chalom, echoed similar remarks on the growing institutional appetite for digital assets.

Our institutional clients are increasingly interested in gaining exposure to digital asset markets and are focused on how to efficiently manage the operational lifecycle of these assets.

Notably, the news comes as crypto asset prices have experienced a drop in value and bears seem to have control over the market.

Source: Read Full Article