The increased interest in liquid staking protocols like Lido Finance comes as Ethereum users and crypto participants, in general, are awash with expectations for staked Ether (ETH) withdrawals.

Ethereum’s Shanghai upgrade should implement EIP-4895, an update that ETH developers have promised will add withdrawal functionality for staked ETH on the network’s beacon chain. This will allow validators to cash out from over 16 million Ether locked up since December 2022. Enabling withdrawals will also allow stakers to access any block rewards.

So far, developers have launched test runs for the upgrade on one public testnet – Zhejiang. Another trial is scheduled on the Sepolia testnet on Tuesday and a third testnet simulation on Goerli is expected sometime in March. These testnets allow developers to observe how the upgrade code runs and work out critical bugs before shipping to the mainnet.

Staking Tokens Soar on Ethereum’s EIP-4895 Hype

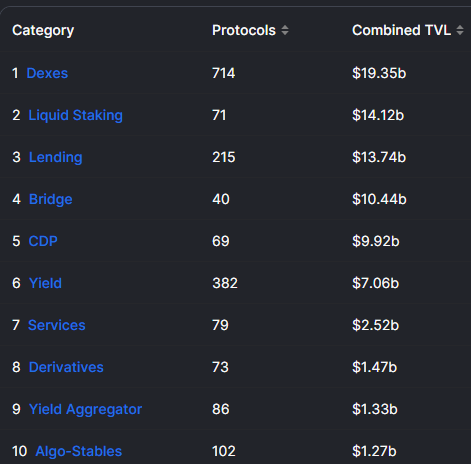

Considering Monday’s data from DeFi Llama, the coming upgrade has seemingly incentivized interest and user participation in liquid staking protocols like Lido which offer a different route to locking up assets.

While the standard staking contracts lock up assets and leave stakers with no access to liquidity, Lido and other liquid staking providers offer derivative tokens like stETH that are pegged to the underlying or staked asset. This means that users who leverage liquid staking services receive tradable tokens that can accumulate yield and stand in for their locked assets.

Indeed, this staking paradigm has garnered significant liquidity from stakers as tokens like LDO and other native tokens issued by liquid staking protocols have surged in price since the start of 2023. Lido Finance’s LDO tokens have seen over 200% in gains in 2022 alone.

Source: Read Full Article