In a highly anticipated announcement for the overall cryptocurrency market and Bitcoin (BTC), the Federal Reserve (Fed) opted to maintain interest rates at their current level, ranging between 5.25% and 5.5%.

The decision aligns with market expectations and signals a continuation of the Fed’s existing policy stance. While the interest rate decision had no immediate impact on Bitcoin’s price, cryptocurrency analysts anticipate a potential shift in market dynamics.

Analysts Predict Bitcoin Reversal Following Fed’s Decision

Bitcoin, the leading cryptocurrency in terms of market capitalization, has experienced a period of consolidation around the crucial $27,000 support level for the past two days.

Despite the absence of significant price fluctuations immediately following the recent interest rate decision, market experts believe this stability could potentially signify the beginning of a trend reversal.

Renowned cryptocurrency analyst Michael Van De Poppe shared his perspective on X (formerly Twitter), suggesting that the era of interest rate hikes may have reached its conclusion.

Van De Poppe went on to indicate that Bitcoin is likely to embark on an upward trajectory from this juncture, noting the importance of exercising caution when interpreting price movements following major news events.

Van De Poppe’s remarks mirror the sentiment among BTC enthusiasts who anticipate the Federal Reserve’s decision to act as a catalyst for the cryptocurrency’s resurgence.

The prevailing hope is that this decision could mark the end of the current market downtrend, paving the way for Bitcoin to reach new yearly highs before the conclusion of 2023.

BTC’s Historical Patterns Suggest Potential Bottom Formation

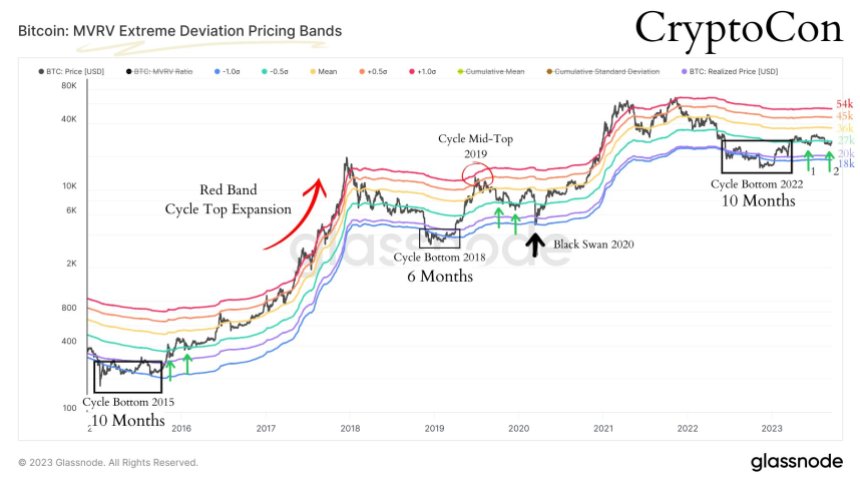

Crypto Con, a renowned crypto analyst provided insights into Bitcoin’s price movements, focusing on its historical patterns and the MVRV (Market Value to Realized Value) deviation bands.

Crypto Con’s analysis highlights the significance of BTC’s recent visit just below the green band, as seen in the chart above, drawing parallels to previous market cycles.

Drawing on historical data, Crypto Con notes that Bitcoin spent approximately 10 months hovering around the bottom purple and blue deviation bands before making its second visit just below the green band.

In 2016, this particular pattern marked a local bottom, and in 2019, it would have done the same if not for unforeseen circumstances such as the black swan event.

Comparing the duration spent at the bottom during the current cycle to that of 2015, Crypto Con highlights a striking similarity. This observation raises the question of whether the significant downside experienced in 2019 was a consequence of the massive price surge that preceded it, with Bitcoin even reaching the cycle top band.

The current value of the red band stands at $54,000, according to Crypto Con’s analysis. However, he assures that this value is subject to change as the market progresses toward “the endgame”.

At present, Bitcoin is trading at $27,100, indicating no change in the 24-hour timeframe. As a result, the impact of the Federal Reserve’s decision on the cryptocurrency and the broader market in the short term remains uncertain.

Whether this news will have a positive effect shortly or prove beneficial for the remainder of the year is yet to be determined.

Featured image from iStock, chart from TradingView.com

Source: Read Full Article