The Bitcoin and crypto prices are influenced by a complex web of factors and intertwined indicators. One such influential force is the U.S. Dollar Index (DXY), which has gained prominence as a vital gauge for Bitcoin and crypto investors.

Over the past three years, BTC and the DXY have been mostly inversely correlated, except in times where crypto-specific factors overshadowed the dollar trends. Whenever the DXY experiences a decline, Bitcoin tends to embark on an impressive rally. Conversely, BTC usually falls when the DXY rises.

DXY Approaches Crucial Level

Since the local high of 104.7 on May 31, the DXY has dropped by nearly 3%. At the time of writing, the DXY stood at 101.8 and is now approaching the yearly low at 100.8 again, which served as support in February and April respectively and initiated a bounce to the upside.

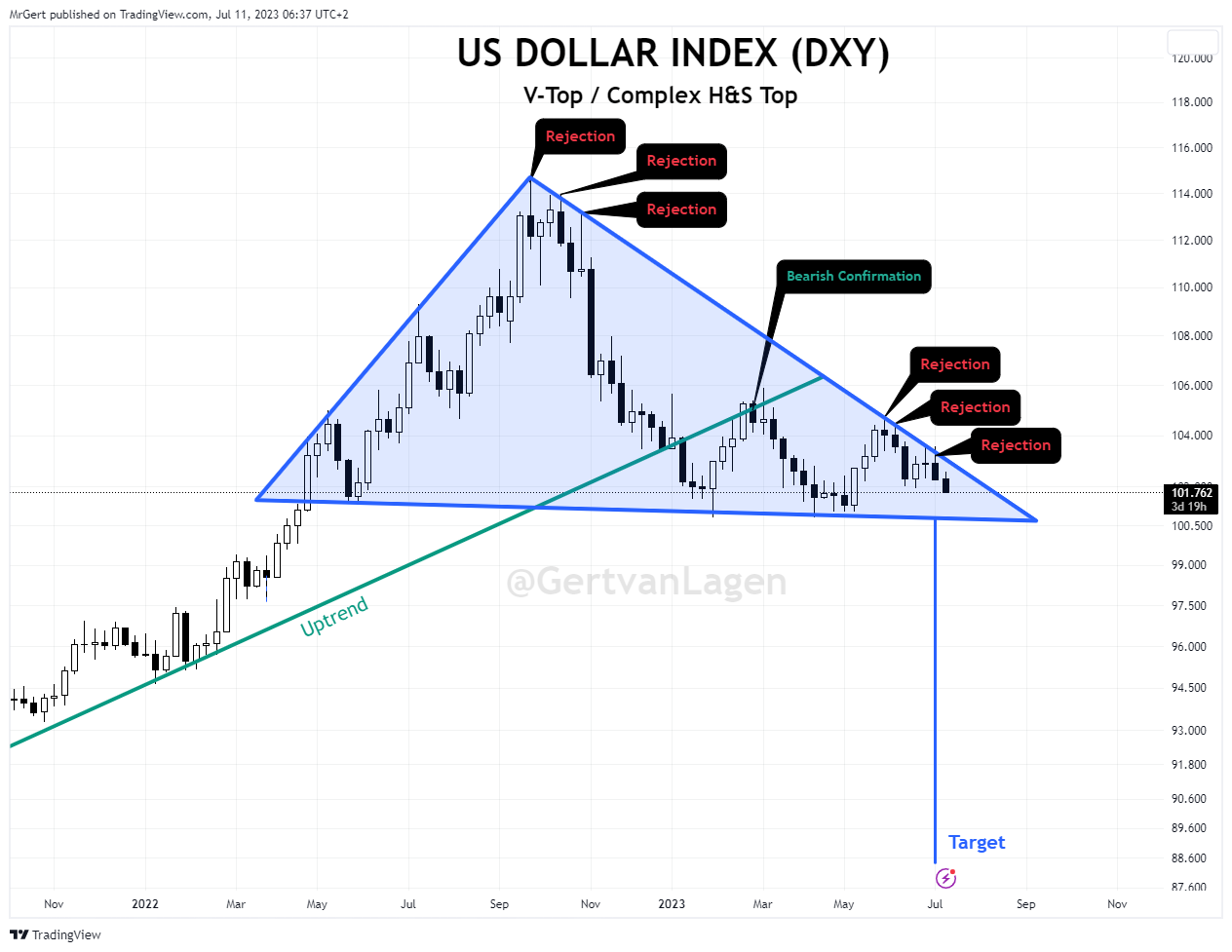

As the renowned trader Gert van Lagen noted via Twitter, the situation for the U.S. dollar index is quite precarious. Van Lagen’s assessment, based on a detailed analysis of the DXY weekly chart, suggests that the US dollar is poised to continue its slide.

Lower lows, lower highs, and the failure to break the blue downtrend for several months all contribute to the bearish sentiment. In addition, the DXY has abandoned the green uptrend and is displaying a bearish confirmation of 3 consecutive weeks. According to van Lagen, a crash of the DXY below 89 could be imminent.

Will The Bitcoin Price Surge Sixfold?

Renowned crypto analyst “Coosh” Alemzadeh also recently took to Twitter to share an intriguing observation about the correlation between the DXY and Bitcoin’s price movements. Alemzadeh’s chart below highlights that during previous instances when the DXY slipped below the critical level of 100, Bitcoin experienced a remarkable surge.

In 2017, Bitcoin witnessed a 10x rally, and in 2020, BTC soared by 7x. Alemzadeh predicts that if history repeats itself and the DXY drops to 89 as it did in the past, Bitcoin could potentially see a substantial price increase of 4x to 6x. The entire crypto market is likely to profit. Alemzadeh shared the chart below and stated:

DXY weekly update: Looks like technical correction is complete which would align w/next BTC impulse initiating.

Remarkably, Jan Happel and Yann Allemann, the founders of Glassnode, have been sharing the same opinion for quite some time. Already at the end of May, the analysts suggested an ABC structure, which has been the main source of headwinds for BTC and other risk assets.

Their prediction was that once the DXY topps out, it will decline sharply, towards the 91-93 until the end of the year. “The decline should unfold in 5 waves likely into late 2023. This move should be very supportive of risk assets and particularly Bitcoin,” say the analysts who also predict the possibility of a blow-off top for risk assets.

At press time, the Bitcoin price remained in its sideways trend, trading at $30,421.

Source: Read Full Article