Once hailed as a compliant cryptocurrency exchange, Binance US now finds itself entangled in a web of legal and operational difficulties. The exchange has come under intense scrutiny for failing to furnish more than 250 requested documents to the Securities and Exchange Commission (SEC), leaving the crypto community rife with concerns regarding Binance’s future stability and its role in the evolving cryptocurrency landscape.

Investors are vigilantly tracking the platform’s trading activity, hoping to glean insights into its fate.

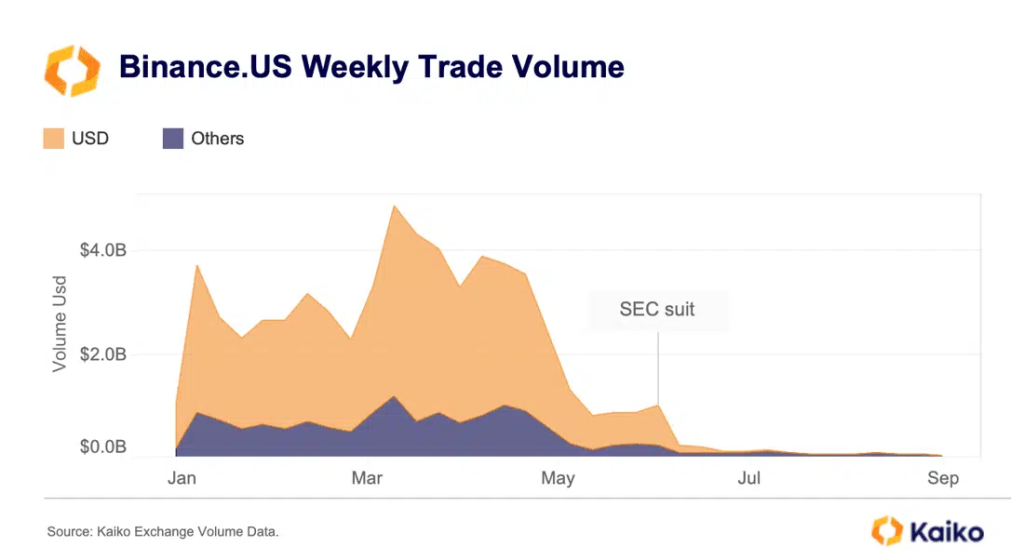

Trading Volume Crashes

Between January and August of 2023, Binance US witnessed a jaw-dropping 98% decline in its monthly trading volume. Furthermore, it anticipates further drops in trading activity for the month of September. In a shocking turn of events, over the span of a single weekend, the platform’s trading volume plummeted to a mere $5.09 million, a stark contrast to the approximately $230 million it boasted on September 17, 2023.

This precipitous decline coincided with legal actions initiated against Binance CEO Changpeng Zhao by the US Commodity Futures Trading Commission and the Securities and Exchange Commission.

Also Read: Binance Wins a Round! Judge Denies SEC Access to Binance.US Software

Key Executive Departures

Adding fuel to the fire, several key executives, including CEO Brian Shorder, Head of Legal Krishna Juvvadi, and Chief Risk Officer Sidney Majalya, have resigned from the company. This mass exodus, duly noted by the SEC, underscores the urgency of investigating these matters. Meanwhile, the SEC has encountered hurdles in its quest for immediate access to Binance.US’s software, underscoring the ongoing tension between the regulator and the exchange.

But What’s Causing the Decline?

This sudden drop is a clear case that investors are fearing an FTX-like explosion soon. Concerns about legal issues or other uncertainties could also be prompting traders to seek alternative platforms. This decline in trading activity serves as a cautionary signal, not only for Binance.US but for the broader US cryptocurrency industry. Recently Coinbase and Gemini have surged in trading activity since Coinbase is in a stronger position in lawsuit than Binance.

Also Read: Former SEC Official Predicts Drama at Upcoming SEC vs. Binance Hearing

Coinbase Steals the Spotlight

To put things into perspective, Coinbase Global Inc., the largest cryptocurrency exchange in the US, reported a daily trading volume of $948 million, a substantial lead over Binance.US’s modest $10.5 million. This stark contrast emphasizes the formidable challenges facing Binance.US as it strives to maintain its market share and user base.

What do you think about Binance US’s current situation? Do you think it will be able to weather the storm?

Source: Read Full Article