Binance Coin (BNB), the native token of the Binance ecosystem, has faced significant challenges in the wake of the recent lawsuits filed by the US Securities and Exchange Commission (SEC) against both crypto exchange Binance and Coinbase.

These regulatory actions have had a profound impact on the cryptocurrency market, stifling any potential upward momentum. As a result, Bitcoin (BTC) retested its lowest point in two months, plummeting to $24,000 at the time of the filing.

While BNB also endured the repercussions of the regulatory pressure, it managed to find some stability around the $220 support level.

How will Binance Coin navigate the tough US regulations and maintain its position within the cryptocurrency landscape?

Challenges For BNB’s Upside Potential

In the latest report on BNB price, a Fibonacci retracement tool has been employed based on the price action observed in the second quarter of 2023. This tool reveals two significant obstacles that could impede BNB’s upward trajectory.

The first obstacle lies at the 23.6% Fibonacci level, marked at $250.8, while the second hurdle resides at the 38.2% Fibonacci level, indicated by $269.8. Should BNB encounter a price denial at these resistance levels, it is likely to experience a retracement, possibly revisiting the $220 support level.

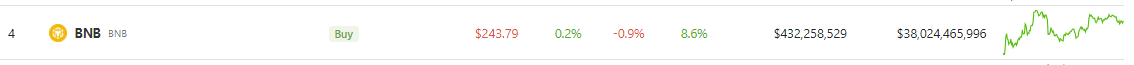

BNB market cap currently at $37.9 billion on the daily chart: TradingView.com

Prone To Aggressive Sell-Off Upon Breaching Strong Support

If BNB manages to surpass the mentioned bullish threshold, there is a possibility of it facing a significant downturn in the form of an aggressive sell-off. In this particular scenario, it would be prudent to keep an eye on the immediate lower support levels at $200 and $184.

These levels hold significance as they could potentially serve as crucial points where the price of BNB may find temporary stability or experience further downward pressure.

Source: Coingecko

At CoinGecko, the current price of BNB stands at $243, reflecting a slight decline of 0.9% over the past 24 hours; however, it has experienced a notable seven-day rally of 8.6%.

Meanwhile, since the SEC sued Binance, open interest (OI) rates for BNB have gradually increased. The OI has increased from $316 million on June 5 to the current level of $385 million. The rising number of open contracts for BNB on the futures market indicates an optimistic outlook.

Source: Coinglass

With Binance Coin currently facing significant hurdles at key levels, the outcome of this price analysis raises the question of whether BNB will manage to overcome these obstacles and regain its upward momentum.

Traders and investors will be closely monitoring the price rejection scenario, the strength of support levels, and the buying pressure indicators to assess BNB’s future performance in the crypto market.

(This site’s content should not be construed as investment advice. Investing involves risk. When you invest, your capital is subject to risk).

Featured image from Currency.com

Source: Read Full Article