Summary

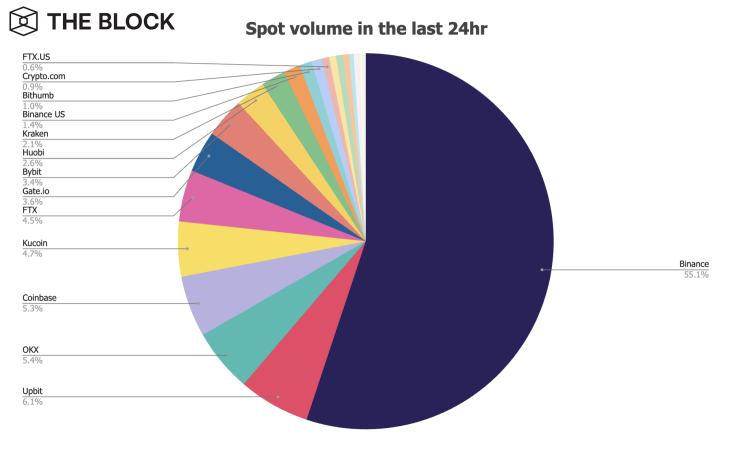

- Crypto exchange Binance powered over half of the total spot trading volume in the last 24 hours, per data from The Block Research.

- Changpeng Zhao’s exchange also leads trading volume for crypto derivative products.

- The platform is miles ahead of other exchanges with the closest competitor being Upbit.

- Binance.US also edged ahead of FTX.US in spot trading volume.

Leading cryptocurrency exchange Binance was the preferred centralized digital asset platform for virtual currency trading over the last 24 hours. According to data from The Block Research, Changpeng’s Zhao exchange edged far ahead of competitors like Coinbase, FTX, Kucoin, and Upbit.

The global crypto leader dominated trading volumes across two digital asset markets – Spot and derivatives. Spot trading refers to the standard buying and selling of an asset, based on its market price.

Crypto derivative trading much like traditional derivative products involves trades deployed based on an underlying asset. Derivatives depend on the value of the underlying asset to determine its own value. Such offerings are also traded at a predetermined price and time.

Data from the research showed that Binance dominated more than 55% of spot trading volume across the crypto industry, accounting for over half of total spot trading in a 24 hours period. Indeed, Cz’s exchange blew competitors out of the water as the closest platform was South Korea’s “Big Four” Upbit with 6.1% of spot trading volume.

Coinbase, OKX, and Upbit were the only three virtual currency exchanges apart from Binance to clock over 5% of spot trading volume, per data from The Block.

CZ’s platform also ruled the derivatives market over the past 24 hours, powering over 54% of derivitates trading volume. The crypto exchange leader was followed by OKX (14%), ByBit (10.2%), and FTX (8.8%).

Binance Leads Spot Markets Amid Global Expansion

The data backs Binance as the hot platform for spot and derivative trading. Interestingly, the development comes at a time when CZ’s exchange is expanding its crypto business across global markets.

In 2022 so far, Binance has set up footholds in Europe with crypto licenses in a myriad of jurisdictions including Cyprus, France, Italy and Spain. A license in German could follow shortly according to hints from Zhao himself.

CZ’s company aslo has a presence in the Middle East, bagging regulatory approval from authorities in Bahrain and Dubai to name a few.

Binance is not alone in these expansion efforts. Competitor exchanges like FTX aslo bagged regulatory nods from multiple financial watchdogs.

Source: Read Full Article