According to the examiner, Celsius used customer deposits to fund the mounting withdrawal requests in the run-up to the withdrawal halt in early June 2022. On multiple occasions, wallets that contained new user deposits were used to “top off” the frictional wallets that were used to facilitate customer withdrawals. Additionally, the processing of withdrawals despite the liquidity issues

“Celsius’s problems did not start in 2022. Rather, serious problems dated back to at least 2020, after Celsius started using customer assets to fund operational expenses and rewards”

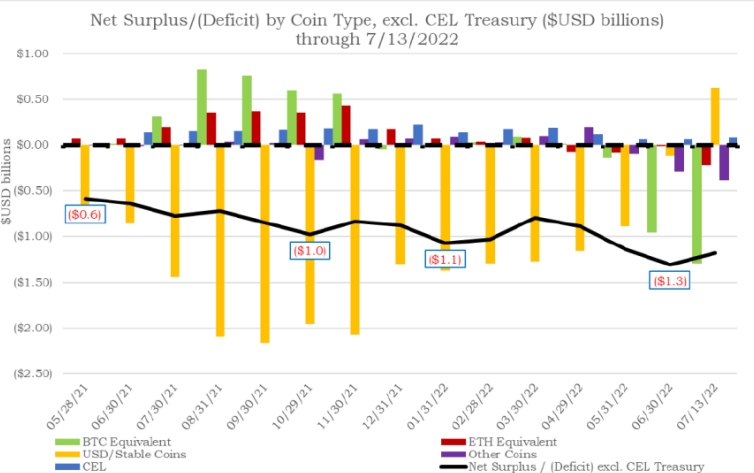

The report also shed light on the shady activities surrounding CEL, Celsius’ native token. Celsius posted customer deposits as collateral to take out stablecoin loans. These stablecoins were used to fund the company’s operations and to acquire BTC and ETH, which were subsequently used to fund CEL buybacks.

According to the examiner, Celsius repeatedly used stablecoins acquired through customer funds to prop up the price of CEL. In April 2022, Celsius’s Coin Deployment Specialist described Celsius’s practice of “using customer stable coins” and “growing short in customer coins” to buy CEL as “very ponzi like.” When asked by the company’s former Vice President of Treasury about the source of cash being used to fund CEL purchases, the Coin Deployment Specialist replied, “users like always.” The liquidity induced from these buybacks helped Celsius founder and former CEO Alex Mashinsky cash out more than $68 million through CEL sales.

Source: Read Full Article