- Ray Dalio, the founder of the world’s largest hedge fund, Bridgewater Associates, has stepped down as the firm’s CIO, Bloomberg reports.

- On September 30, Dalio transferred all his voting rights to the board of directors, entrusting its future to a new generation of leaders.

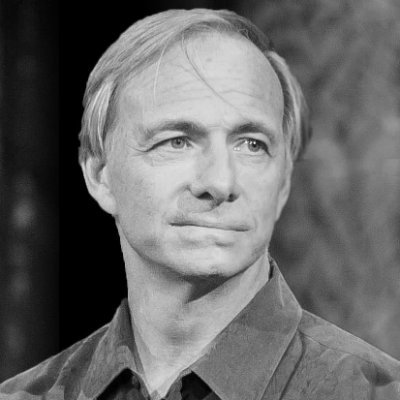

Ray Dalio, founder of Bridgewater Associates, one of the largest hedge funds in the world, is stepping down from his position as the firm’s CIO. In an interview with Bloomberg, Dalio stated that he is finally surrendering control of Bridgewater Associates to a new younger generation, and has transferred his voting rights to the company’s board of directors.

Ray Dalio Is Finally Letting Go

Per a Bloomberg report, Dalio has transferred his voting rights to the company’s board of directors, designating its future and the firm’s $150 billion in assets to “a younger generation of leaders.”

“This was the natural progression of events; as soon as we were ready, we went ahead.” ” I didn’t want to hold on until I died.” Dalio told Bloomberg.

Bridgewater Associates, dubbed the largest hedge fund, was founded by Ray Dalio in 1975. The firm actively manages assets worth $150 billion and serves institutional clients, including pension funds, endowments, foundations, foreign governments, and central banks.

In a series of comprehensive Tweets, Dalio announced his decision to surrender control of the firm to the next generation, adding that he could now visualise Bridgwaters performing exceptionally well without his active support.

..From my starting Bridgewater w/ 2 people helping me in my 2-bedroom apartment to a multi-generation institution w/ 1,300 people that I’m helping. I can now visualize it doing great things for generations w/ out me. That’s as good as it gets. (2/11)

Dalio, 73, held the position as the Bridgewaters’ CIO since 1985, leading the firm to evolve further ahead. Additionally announcing his succession plan through Twitter, Dalio added that he will keep mentoring Bob Prince and Greg Jensen, the co-chief investment officers of Bridgewater Associates. Dalio further declared that he would serve as a member of the operating board and as a senior investor.

“Hopefully until I die, I will continue to be a mentor, an investor, and a board member at Bridgewater, because I and they love doing those things together,” Dalio said. “That’s a dream come true.”

..I’m deeply grateful for everything these people have done to bring us to this moment.While it hasn’t been easy over the last 12 years, we made it! Over the last 2 yrs I have watched & mentored them so they could run Bridgewater w/out my interference and they did great. (8/11)

In January, the firm announced the selection of Nir Bar Dea and Mark Bertoloni as the firm’s CEOs. Later on, Greg Jensen and Bob Prince were assigned the roles of Bridgewater’s CIOs.

“Bridgewater’s strength has and will always remain a deep bench of investment and advisory talent. The sum of those individuals, led by our co-CEOs and co-CIOs, Greg Jensen and Bob Prince, and the systematisation of our investment process, is bigger and more impactful than any individual. As Bridgewater embarks on its newest chapter, we are honoured to write it with you. ” The statement later added

Speaking about his decision to entrust the firm to the new set of leadership, Dalio reiterated his positive stance, adding that succession means that he can dedicate more time to philanthropic endeavours and the lessons that he has learned as a lifelong student of the economy. He later added that he is not interested in selling his stake at Bridgewaters and looks forward to mentoring the team for years to come.

..I’m deeply grateful for everything these people have done to bring us to this moment.While it hasn’t been easy over the last 12 years, we made it! Over the last 2 yrs I have watched & mentored them so they could run Bridgewater w/out my interference and they did great. (8/11)

Image: Ray Dalio/Twitter

Source: Read Full Article