Willy Woo, a well-known on-chain analyst, recently shared his perspective on Bitcoin’s (BTC) market movements, predicting a potential retest of the $39,000 zone before any continuation of a bullish trend.

Understanding Trading Gaps and Their Significance

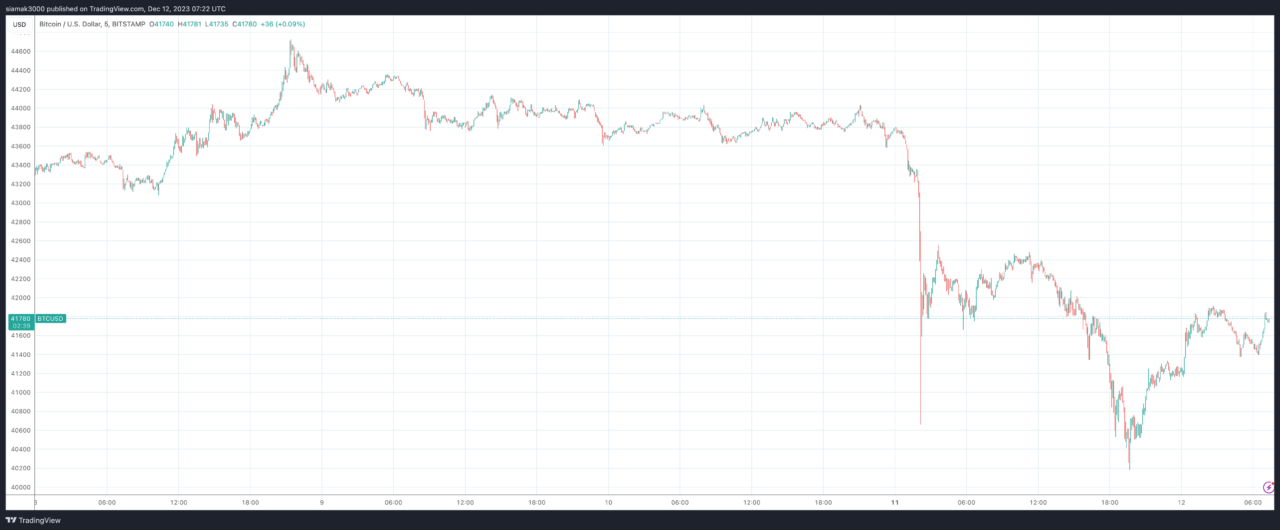

Woo pointed out a significant gap in Bitcoin’s price on the Chicago Mercantile Exchange (CME) futures market, near $39,700. Trading gaps occur when there is a noticeable difference between the closing price of an asset on one trading day and its opening price on the next. These gaps are visually evident on price charts and are considered important by traders for several reasons:

- Indicators of Market Sentiment: Gaps can reflect bullish or bearish sentiment.

- Predictive Nature: Many traders believe that prices often ‘fill’ the gap, returning to the gap’s level before continuing the trend.

- Volume and Volatility: Gaps are often accompanied by increased volume and volatility, offering trading opportunities.

In cryptocurrency markets like Bitcoin, these gaps are closely watched as they can indicate market inefficiencies, the speculative nature of the asset, and areas of liquidity and price discovery. Woo also noted another unfilled gap near $20,000, suggesting that historically, most gaps on the CME have eventually been filled.

Woo’s Comprehensive Analysis of Bullish Factors for Bitcoin

Woo’s analysis included several factors that could contribute to a bullish scenario for Bitcoin.

Potential for Lower Interest Rates: Woo discussed how lower interest rates could positively impact Bitcoin. In an environment where traditional savings accounts and fixed-income investments yield lower returns due to reduced interest rates, alternative assets like Bitcoin could become more attractive to investors seeking higher returns. This shift in investment preference could increase demand for Bitcoin, potentially driving up its price.

Return of Global Liquidity: Woo pointed to the possibility of global liquidity returning to the market as a bullish sign for Bitcoin. Global liquidity refers to the availability of investable capital worldwide. When there is an increase in global liquidity, it often leads to more capital flowing into various asset classes, including cryptocurrencies like Bitcoin. This influx of investment can drive up the price of Bitcoin as more investors buy into the market.

Peak in the US Dollar Index (DXY): The US dollar index (DXY) tracks the strength of the dollar against a basket of other major currencies. Woo suggested that a peak in the DXY might signal a forthcoming weakening of the dollar. When the dollar weakens, investors often look for alternative stores of value, such as Bitcoin, to hedge against currency devaluation. This increased demand for Bitcoin as a hedge could contribute to its price appreciation.

Imminent Launch of a spot Bitcoin Spot ETF: Woo mentioned the potential launch of a spot Bitcoin Exchange-Traded Fund (ETF) as a bullish factor. A spot ETF would allow investors to gain exposure to Bitcoin’s price movements without owning the actual cryptocurrency. This could lower the barrier to entry for investors who are hesitant to invest directly in Bitcoin due to concerns about storage and security. The availability of a spot Bitcoin ETF could attract a new wave of institutional and retail investors, potentially boosting Bitcoin’s price.

Demand from Public Company Treasuries: Woo observed strong demand for Bitcoin from public company treasuries, as evidenced by companies like MicroStrategy significantly investing in Bitcoin. This trend indicates growing institutional acceptance of Bitcoin as a legitimate investment and store of value. As more companies allocate a portion of their treasuries to Bitcoin, it could signal confidence in Bitcoin’s long-term value, encouraging more investors to enter the market.

Decline in Paper BTC: Woo noted a decline in paper BTC, referring to Bitcoin derivatives and similar financial products. A shift away from these derivatives towards actual Bitcoin holdings suggests a market preference for holding the underlying asset. This could indicate a belief in the long-term stability and potential growth of Bitcoin, potentially leading to a more stable and upward-trending market.

Peter Schiff’s Comments as a Contrarian Indicator: Finally, Woo interpreted Peter Schiff’s critical comments about Bitcoin, especially in comparison to gold’s performance, as a contrarian indicator. In the crypto community, negative remarks from well-known skeptics like Schiff are often seen as bullish signals. The sentiment is that when vocal critics express bearish views on Bitcoin, it could ironically precede a rise in its value, as has been observed in the past.

Woo’s In-Depth Look at Bearish Factors for Bitcoin

Conversely, Woo presented several reasons for a potential bearish outlook on Bitcoin.

Development of Bearish Technicals: Woo highlighted the emergence of bearish technical patterns in Bitcoin’s price charts. These technical patterns, such as head-and-shoulders, descending triangles, or bearish crossovers in moving averages, are often interpreted by traders as signs that the market could be turning bearish. Such patterns can lead to a decrease in investor confidence and potentially trigger a sell-off, contributing to a downward trend in Bitcoin’s price.

Return of Spot Flows into Exchanges: Woo noted the increase in spot flows of Bitcoin back into exchanges. This trend is significant because when more Bitcoin is moved onto exchanges, it often indicates that holders are preparing to sell. An increase in the available supply of Bitcoin on exchanges can lead to selling pressure, which might drive down the price, especially if the inflow surpasses buying demand.

CME Gap at $39,000 as a Bearish Indicator: The CME gap at $39,000, which Woo mentioned, is seen as a bearish indicator. In market analysis, unfilled gaps often act as targets for price movement. In this case, the existence of a gap at $39,000 could suggest that Bitcoin’s price might move downward to fill this gap before any potential bullish reversal or continuation occurs.

Weakening Demand for Bitcoin in the Futures Market: Woo observed a decrease in demand for Bitcoin in the futures market. Futures markets are often used by investors to speculate on the future price of an asset. A decline in demand in this market could indicate that traders are less confident about Bitcoin’s price increasing in the near future. This reduced interest can be a precursor to a decrease in price, as futures markets can significantly influence spot market prices.

Potential for Profitable Long Liquidations by Sweeping Lows: Finally, Woo pointed out the possibility of profitable long liquidations. In the cryptocurrency market, many traders use leverage to amplify their potential gains. However, if the market moves against these leveraged positions, it can lead to forced liquidations, where the positions are automatically closed at a loss. If Bitcoin’s price starts to fall and hits ‘stop-loss’ levels, it could trigger a cascade of these liquidations, further driving the price down. This phenomenon is known as ‘sweeping the lows,’ where the market moves to a point that triggers these liquidations, leading to a sharp and sudden drop in price.

Current Market Position

At the time of writing, Bitcoin was trading at $41,760 (down 5.2% in the past 24-hour period), which is above the aforementioned CME gap. This positioning suggests a potential retest of the $39,000 level in the near future.

Featured Image via Pixabay

Source: Read Full Article