Introduction

According to a recent report by CoinShares, a prominent Europe-based crypto-focused investment and trading group, there are several key trends shaping the digital asset investment landscape. Released on 16 October 2023, the CoinShares “Digital Asset Fund Flows Weekly” report offers an in-depth look at investment flows in Bitcoin, various altcoins, and regional investment patterns.

Sentiment on the Rise

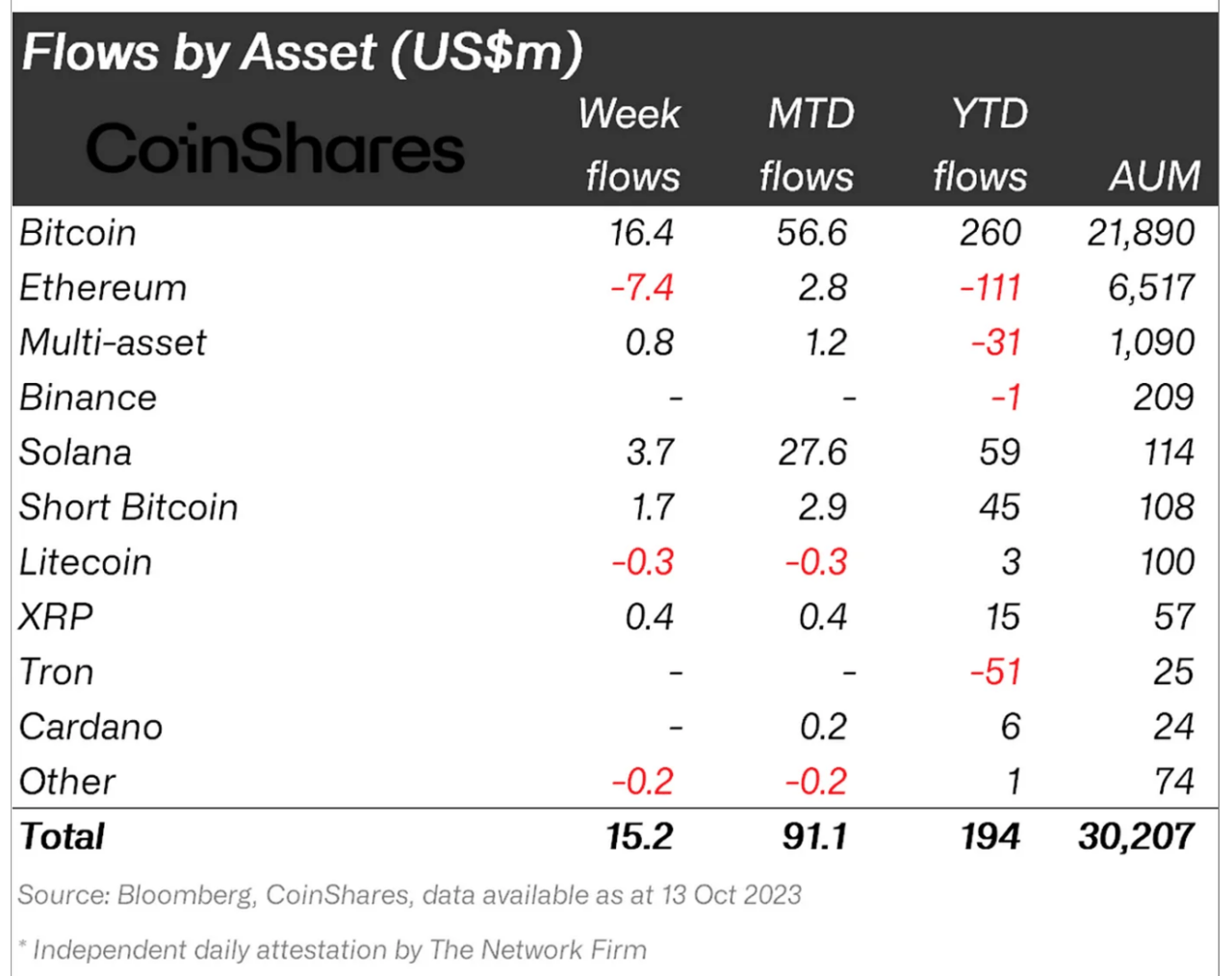

CoinShares’ report indicates that the investment climate for digital assets is improving. For the third consecutive week, digital asset investment products have attracted inflows totaling $15 million. However, CoinShares also points out that trading volumes are still 27% below the 2023 yearly average.

Bitcoin Maintains Its Lure

According to CoinShares, Bitcoin continues to attract significant investment, with inflows of $16 million last week. This brings the total inflows for the year to $260 million. CoinShares also notes that short-bitcoin positions saw an increase, with last week’s inflows reaching $1.7 million.

Mixed Fortunes for Altcoins

CoinShares reports that the past week was less favorable for several altcoins. Tezos, Litecoin, and Chainlink all faced outflows, amounting to $0.25 million, $0.28 million, and $0.31 million, respectively. On a brighter note, CoinShares highlights that XRP enjoyed modest inflows of $0.42 million, marking its 25th week of consecutive inflows. This is particularly significant given XRP’s successful legal challenges against the SEC, a point that underscores the investment community’s ongoing support.

Regional Investment Patterns

CoinShares’ report also delves into regional investment flows. While the U.S. saw only minimal investment activity, Europe experienced a net inflow of $7 million last week. CoinShares identifies Sweden as the lone European country to record investment outflows.

Regulatory Developments

According to CoinShares, the data in their report, accurate as of the end of trading on Friday, did not include the recent U.S. regulatory development where the SEC chose not to appeal the Grayscale legal challenge. This decision could potentially set the stage for spot-based ETFs in the United States.

Ethereum and Other Notable Altcoins

CoinShares points out that Ethereum experienced outflows of $7.5 million last week, a move that possibly reflects ongoing concerns about the protocol’s design. In contrast, CoinShares highlights that Solana, XRP, and Cardano had the highest year-to-date flows among all altcoins, surpassing even Ethereum.

Featured Image via Midjourney

Source: Read Full Article